From Celestia and Jito to AltLayer, projects launched in recent months have generously rewarded their early community participants with substantial airdrops, in turn earning fervent community engagement and value recognition. The airdrops from these projects were valued between $200 million and more than $1 billion, and as expected, airdrop hunters are already on the hunt for the next potential protocol.

In this article, we will discuss how EigenLayer’s ETH Restaking can bring a potential 10x increase in rewards to the conventional ETH staking market. We'll also explore how to participate in this lucrative opportunity with an estimated 40% return through the InfStones platform in the simplest and safest manner.

For more information on the Restaking track and the EigenLayer project, please read here.

Disclaimer: The projections regarding ETH restaking and its potential returns are speculative and subject to market volatility. Actual results may vary.

Understanding Airdrop and Restaking Connection

Airdrops are a method used in the crypto ecosystem to distribute new tokens or coins directly to the wallets of users, usually for free. Airdrops can be conditional, requiring users to perform specific tasks such as holding a minimum amount of another token, posting about the project on social media, or being an active member of the project's community. They are often employed by new blockchain projects to incentivize adoption, increase the token's distribution, or reward early contributors.

Restaking, on the other hand, is a concept, particularly in proof-of-stake (PoS) and delegated proof-of-stake (DPoS) blockchain networks, that involves automatically reinvesting staking rewards to compound the stakeholder's voting power and potential earnings. This process enhances the stakeholder's influence in the network and increases their chances of receiving future block rewards.

Interestingly, restaking can also intersect with airdrops, as maintaining an active staking position might be a criterion for eligibility to receive airdrops, creating a symbiotic relationship that encourages continuous participation on certain blockchain protocols.

ETH restaking is rapidly becoming the biggest crypto trend of the year, with EigenLayer standing at the forefront. Researchers predict that EigenLayer's launch could distribute an airdrop worth up to $2 billion to its community, potentially making it the biggest airdrop in crypto history. The expected return on investment is estimated to be as high as ~40% for airdrop recipients, and its participation method is incredibly straightforward: staking ETH.

The ALT Airdrop Ignites 2024 Restaking Market

On January 25, 2024, EigenLayer's AVS project, AltLayer, got listed on Binance, and 300 million ALT tokens were airdropped to the community contributors and early participants. By January 29, 2024, the value of this airdrop had reached $130 million. Notably, 13.05% of the airdrop was allocated to the Restakers on EigenLayer, with each ETH-staking wallet being eligible for up to 6,667 ALT airdrop (worth $3,000). This evokes memories of the Uniswap airdrop in 2020, where each eligible wallet received 400 UNI (valued at $1,200 on the day of the airdrop).

The ALT token airdrop has drawn the crypto community's attention to EigenLayer and the Restaking track. Additionally, as one of the 13 AVS projects currently announced by EigenLayer, AltLayer's airdrop has set a precedent for other AVS projects. The crypto community widely believes that other AVS projects launching in 2024 are very likely to follow AltLayer's lead with airdrops to enhance their influence in the EigenLayer community.

There's a very straightforward reason behind this: EigenLayer's Restakers will develop a favorable view of the projects that offer airdrops, thereby choosing to protect these AVS projects with their staked ETH and helping their long-term development.

The ALT token airdrop at the start of 2024 has already attracted attention to the EigenLayer restaking feature. Additionally, it provides a basis for us to estimate the return on investment for participants. In a subsequent section, we will demonstrate how this restaking process can bring a potential 10x increase in rewards for staking your Ethereum tokens. But before then, let's quickly explore the benefits of restaking.

The Triple Benefits of Restaking

1st Layer of Benefit - ETH Staking Returns: ~4%

Participating in Restaking first inherits the earnings from ETH staking. According to data from the InfStones Safe Stake platform, the current staking yield for ETH is around 3.9%. This yield is expected to increase with the rise in Ethereum chain activity, but for simplicity, we'll calculate using 4%.

2nd Layer of Benefit - EigenLayer Airdrop: ~33%

EigenLayer, a leading project in the Restaking track, boasts endorsements from well-known investors such as a16z, Blockchain Capital, Polychain Capital, and Coinbase Ventures. Bankless suggests in their article that Celestia can be used as a valid reference for estimating EigenLayer's market cap, as both have similar objectives: providing Data Availability (DA). Bankless estimates that EigenLayer's Fully Diluted Valuation (FDV) could reach $20 billion. Assuming EigenLayer allocates 10% of its tokens for airdrops, the total value of its airdrop could reach a staggering $2 billion!

With EigenLayer's current TVL at 900K ETH ($2 billion), we anticipate that EigenLayer will attract more ETH staking in 2024. Assuming the TVL reaches three times its current size (about $6 billion) by the time of the EigenLayer airdrop, the return rate from the airdrop alone could reach an astonishing 33%!

3rd Layer of Benefit - 10+ AVS Projects Airdrop: ~4%

The ALT token airdrop has demonstrated that AVS projects will almost certainly airdrop to EigenLayer restakers, opening up greater potential returns for those participating in EigenLayer Restaking. Compared to EigenLayer itself, the numerous AVS projects on EigenLayer undoubtedly have greater value uncertainty and potentially larger upside in a bull market.

Here, we simply multiply the return from the ALT airdrop by the total number of AVS projects to estimate the total value that AVS airdrops might bring.

As previously mentioned, the total value of the ALT airdrop was $130 million, with 13.05% allocated to EigenLayer stakers, equating to $17 million. Therefore, the total return from 13 AVS projects' airdrops is estimated at $220 million. Continuing with our assumption about EigenLayer's TVL, the return rate from AVS project airdrops would be about 3.7%, nearly equal to the return rate from ETH Staking itself!

*Please note, all the above estimates are based on the current market performance of the involved projects.

Earning Restaking Rewards Simply and Safely Through InfStones

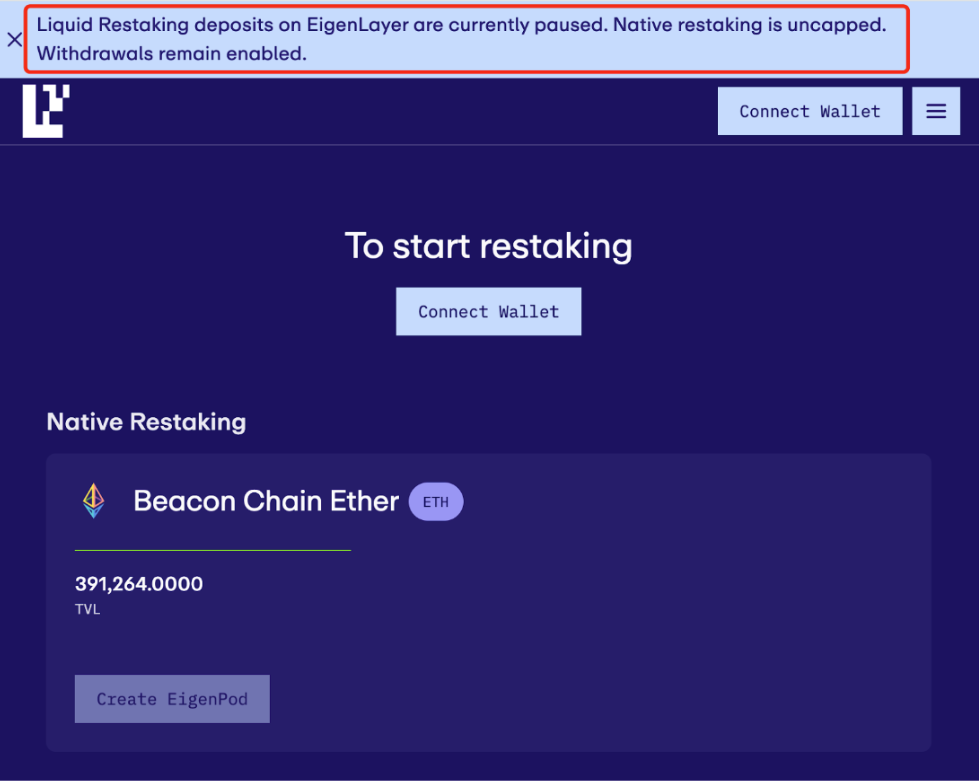

So, how can we maximize the triple benefits of Restaking on EigenLayer? EigenLayer offers two methods of ETH restaking, one of which involves using LST tokens with a cap. This cap is often rapidly exhausted after being opened to the community, which is a major reason many have been unable to participate in the past.

However, EigenLayer has always provided an uncapped entry method for holders of more than 32 ETH, known as EigenLayer Native Restaking.

In addition to holding over 32 ETH, EigenLayer Native Restaking also requires participants to maintain their own Ethereum Validator. This requirement has been a stumbling block not just for small ETH holders but also for large ETH holders without technical operational capabilities. However, the InfStones platform allows you to participate in EigenLayer Native Restaking in a straightforward and secure manner, requiring no node operating knowledge.

Since the launch of the Ethereum Beacon Chain in 2020, InfStones has operated over 20,000 validators to date. With our intuitive Safe Stake service, you can confidently entrust the challenging task of node operation to InfStones and await the airdrop rewards from participating in restaking.

For a detailed participation tutorial, please see the link. Here, you will find a step-by-step guide through the entire process.

If you still have questions about participating in Restaking through InfStones, feel free to contact us through our social channels: Email, Discord, Telegram

If you wish to stake more than 3,200 ETH, please contact our business team through Contact Us. We are more than happy to provide VIP guidance.

If you are an institution or a project intending to participate in the Restaking track, please get in touch with our business team. We provide complete technical solutions for institutions and are eager to open the doors to Restaking for your community.

InfStones is an advanced, enterprise-grade Platform as a Service (PaaS) blockchain infrastructure provider trusted by the top blockchain companies in the world. InfStones’ AI-based infrastructure provides developers worldwide with a rugged, powerful node management platform alongside an easy-to-use API. With over 20,000 nodes supported on over 80 blockchains, InfStones gives developers all the control they need - reliability, speed, efficiency, security, and scalability - for cross-chain DeFi, NFT, GameFi, and decentralized application development.

InfStones is trusted by the biggest blockchain companies in the world including Binance, CoinList, BitGo, OKX, Chainlink, Polygon, Harmony, and KuCoin, among a hundred other customers. InfStones is dedicated to developing the next evolution of a better world through limitless Web3 innovation.

InfStones Loyalty Points - EigenLayer Season 1 Conclusion & What's Next

Introduce InfStones CARV Perk: Unlock Extra Airdrop and Exclusive Benefit

How to Change Your Delegation to InfStones on EigenLayer