Stride is a Cosmos-based liquid staking platform that supports IBC-compatible tokens. When a user stakes on Stride, they receive not just staking rewards, but also Stride’s derivative receipt tokens, stTokens (for example, stATOM). Users can exchange these stTokens for the original non-derivative assets, alongside their staking rewards at any time. This approach allows users to simultaneously participate in yield-generating DeFi protocols on the Cosmos ecosystem with their stTokens.

On Proof-of-Stake (PoS) blockchains, users can typically lock up their tokens to participate in the staking process to help secure the network. While these tokens are earning staking rewards, they’re inaccessible and cannot be used as collateral for other purposes — they aren’t liquid.

This approach prevents users from taking advantage of DeFi opportunities like lending or providing liquidity. It forces them to choose between earning staking rewards or using their tokens for other yield-generating functions. Stride is addressing this problem through its industry-leading liquid staking solution.

What is Liquid Staking?

Liquid staking allows users to increase their capital efficiency, by providing a receipt token for their reward-generating staked assets, so they can be simultaneously used as collateral in DeFi applications. Platforms like Stride make this possible by creating an intermediate layer between users and their staked tokens. With liquid staking, users get the added benefit of not needing to give up control of their staked tokens to earn rewards.

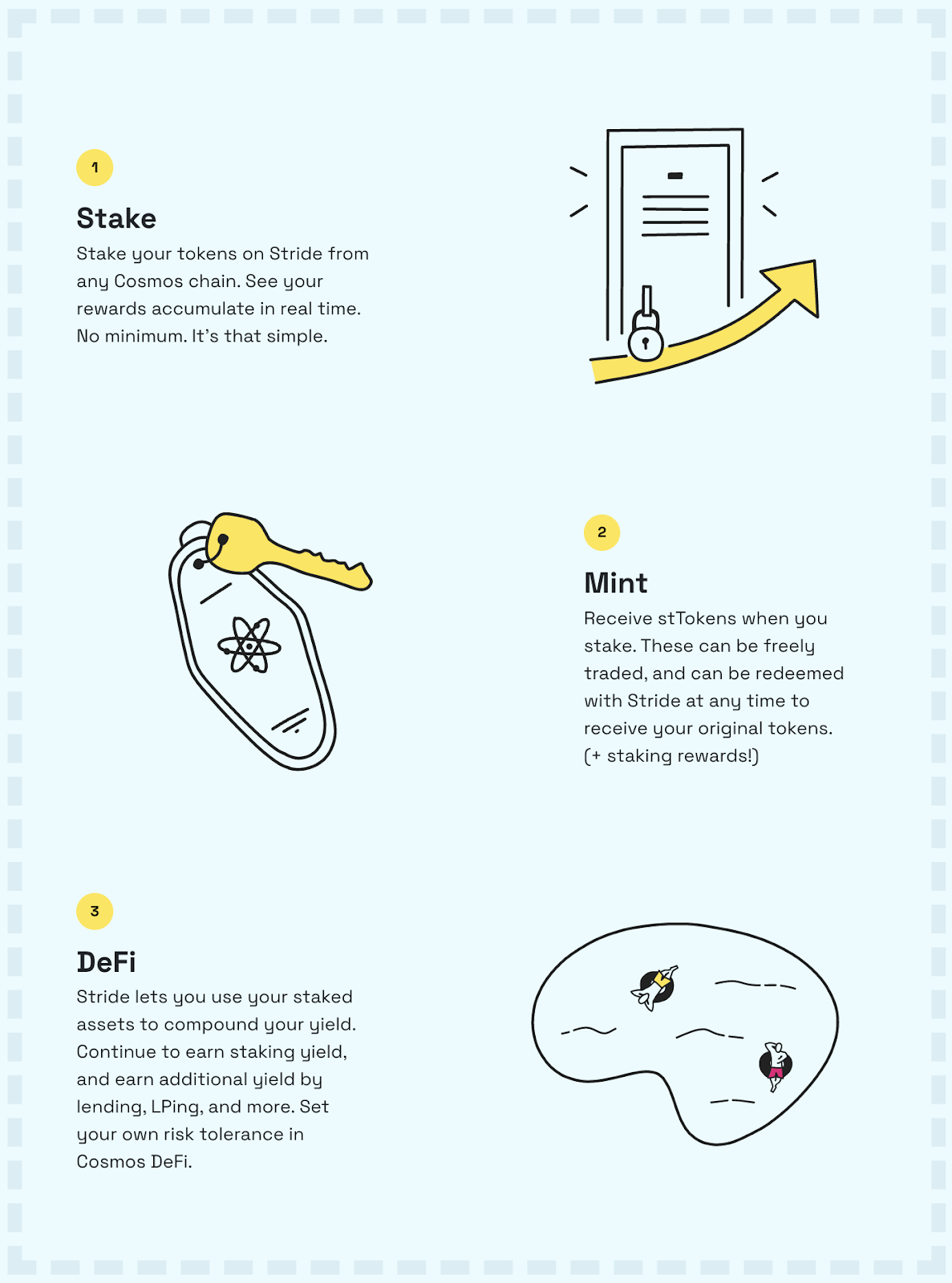

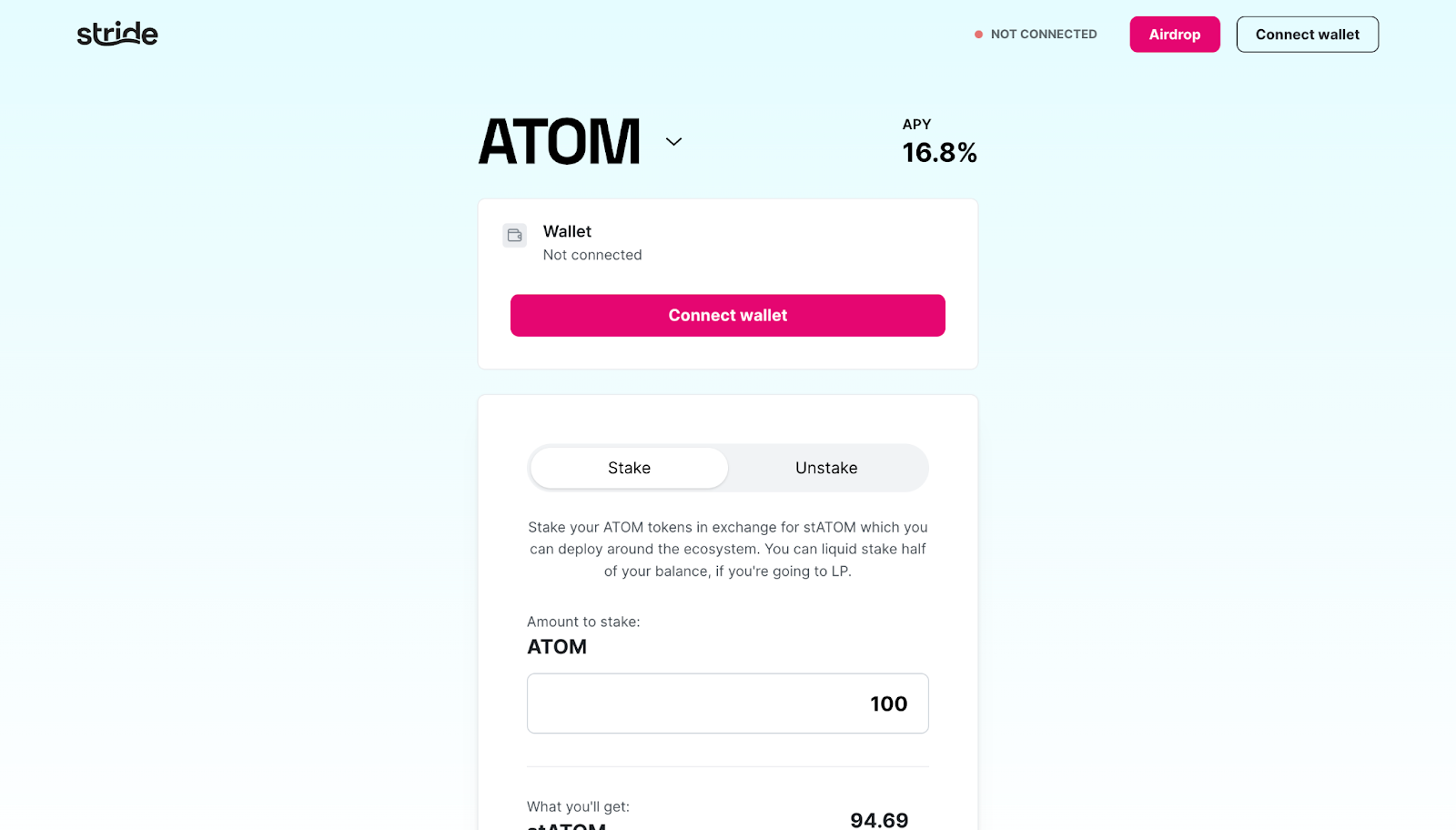

Here is a step-by-step example explaining the process of liquid staking ATOM tokens through the Stride platform.

Step 1

First, users will enter the quantity of ATOM tokens they wish to liquid stake.

Step 2

Then, they’ll confirm the transaction details, including the amount of ATOM tokens being staked, and the corresponding amount of stATOM (the derivative receipt token) they'll receive.

Step 3

Once confirmed, the users’ original ATOM tokens will be transferred from their crypto wallet to the Stride protocol, and the corresponding amount of stATOM will be transferred back to their wallet.

Step 4

The stATOM receipt tokens can now be traded or used as collateral in various DeFi applications, while the original ATOM tokens are earning staking rewards.

Step 5

Users can redeem their stATOM tokens at any time in exchange for the original ATOM tokens, with all earned staking rewards.

By offering users the ability to simultaneously earn both staking rewards and DeFi yields on their tokens, Stride is helping to bridge the gap between these two worlds, and make it easier to take advantage of all the opportunities that the Cosmos ecosystem offers.

How Stride Works

Stride uses a decentralized, permissionless model to provide liquidity for staked assets. Behind the scenes, Stride seamlessly stakes users' tokens on its host chain and compounds their rewards.

Image Credit: Stride’s Documentation

On the technical side, Stride is built using the Cosmos SDK, Tendermint BFT, and Ignite CLI. The protocol implements a variety of cutting-edge interoperability technologies — most notably, Interchain Accounts (ICA).

Interchain Accounts

ICA is a revolutionary new feature developed by the Cosmos team that enables users to control a host chain account from a controller chain. One of ICA’s many innovative use-cases is that it allows users to securely transfer assets between different appchains within the Cosmos ecosystem.

Stride is the first transfer solution that leverages Interchain Accounts to facilitate the movement of digital assets between different appchains in the Cosmos ecosystem. When a user liquid stakes their tokens through Stride, they are creating a virtual Stride account that’s linked to their actual account on the original chain. This allows them to transfer assets between chains with the virtual account in a simple and secure manner, without having to worry about any of the technicalities.

You can learn more about Stride's technical architecture on its documentation page.

The Mission – Minimalism, Neutrality & Security

Stride is designed to be minimalistic and neutral in nature, with a focus on providing liquidity for staked assets. This allows Stride to support a wide range of appchains within the Cosmos ecosystem, without being tied to any one of them in particular.

Stride also uses a Cosmos-native feature called Interchain Security (ICS), and implements governance modules to ensure the security of both its platform and user assets. The protocol is also being regularly audited by CertiK and Oak Security, two leading blockchain security firms, to make sure its codebase and security measures are rigorously tested and reviewed for exploits or small errors.

Currently, Stride supports liquid staking for several Cosmos ecosystem appchains, including:

- Cosmos Hub (stATOM)

- Osmosis (stOSMO)

- Juno (stJUNO), and

- Stargaze (stSTARS)

Furthermore, onboarding new chains to Stride is extremely straightforward - additional networks can be proposed for onboarding through a governance vote. This allows the Stride network to remain flexible and adaptable for the future.

Comparing Stride to Other Liquid Staking Platforms

One of the key differences between Stride and other liquid staking platforms is the fact that the platform intentionally focuses on minimalism and blockchain neutrality.

In contrast, other liquid staking platforms may have a more narrow focus, or may be closely tied to a specific chain, which can lead to limitations for their flexibility and adaptability in the long term. Stride is designed to provide liquidity for staked assets and nothing else, so it can work with a wide range of appchains without being restricted to any one in particular.

Another key differentiator for Stride is its approach to security. In addition to leveraging ICS, Stride takes multiple measures to ensure the platform's security and the safety of its users' assets including rate limiting, and bounties for white hat hackers through the Immunefi platform.

Stride's contributors are also exploring ways to issue liquid staking derivatives for assets outside Cosmos. Through collaborations with Axelar and Composable Finance, the company intends to bring stTokens to Ethereum and other ecosystems such as NEAR and Polkadot via their recently released annual roadmap.

Conclusion

Stride is helping to drive the adoption and growth of PoS blockchains by providing a convenient and secure way for users to increase their capital efficiency by simultaneously earning both staking rewards and DeFi yields across multiple chains. Stride is proving itself as a leader in the liquid staking space by leveraging cutting-edge technologies, and its success may pave the way for similar solutions in other blockchain ecosystems.

InfStones is an advanced, enterprise-grade Platform as a Service (PaaS) blockchain infrastructure provider trusted by the top blockchain companies in the world. InfStones’ AI-based infrastructure provides developers worldwide with a rugged, powerful node management platform alongside an easy-to-use API. With over 20,000 nodes supported on over 80 blockchains, InfStones gives developers all the control they need - reliability, speed, efficiency, security, and scalability - for cross-chain DeFi, NFT, GameFi, and decentralized application development.

InfStones is trusted by the biggest blockchain companies in the world including Binance, CoinList, BitGo, OKX, Chainlink, Polygon, Harmony, and KuCoin, among a hundred other customers. InfStones is dedicated to developing the next evolution of a better world through limitless Web3 innovation.